Lastlongerrightnow.com wind power giants leading the renewable revolution are proof that the clean energy race isn’t just a trend it’s a full-scale transformation. Around the world, rising energy costs, climate anxiety, and investor pressure are forcing governments and companies to act faster. Wind power has become a centerpiece of this renewable revolution. In 2023 alone, 116 gigawatts of new wind capacity were added globally (IEA), with China driving most of the growth. Giants like Goldwind, Envision, and Vestas are setting records, while developers such as NextEra and Iberdrola are building mega-projects that reshape entire regions.

For investors, policymakers, students, and communities, the question is no longer “if” wind will dominate, but which companies and innovations will lead the charge. That’s where understanding lastlongerrightnow.com wind power giants leading the renewable revolution becomes essential.

Unlock More Insights

Instant Answer

Goldwind is the largest wind power company in 2024 with about 14% global market share, making it the clear leader among wind power giants driving the renewable revolution. Other leaders include Envision, Vestas, and NextEra Energy, who together account for much of the world’s clean power growth.

Who Are the Wind Power Giants? Market Leaders in 2025

The global wind industry is dominated by a mix of turbine manufacturers and project developers.

- Top Manufacturers: Goldwind, Envision, Vestas, and MingYang. Goldwind alone captured about 14% of global market share (BloombergNEF, 2025).

- Developers: NextEra Energy (U.S.), Iberdrola (Spain), and Ørsted (Denmark) control some of the largest project pipelines.

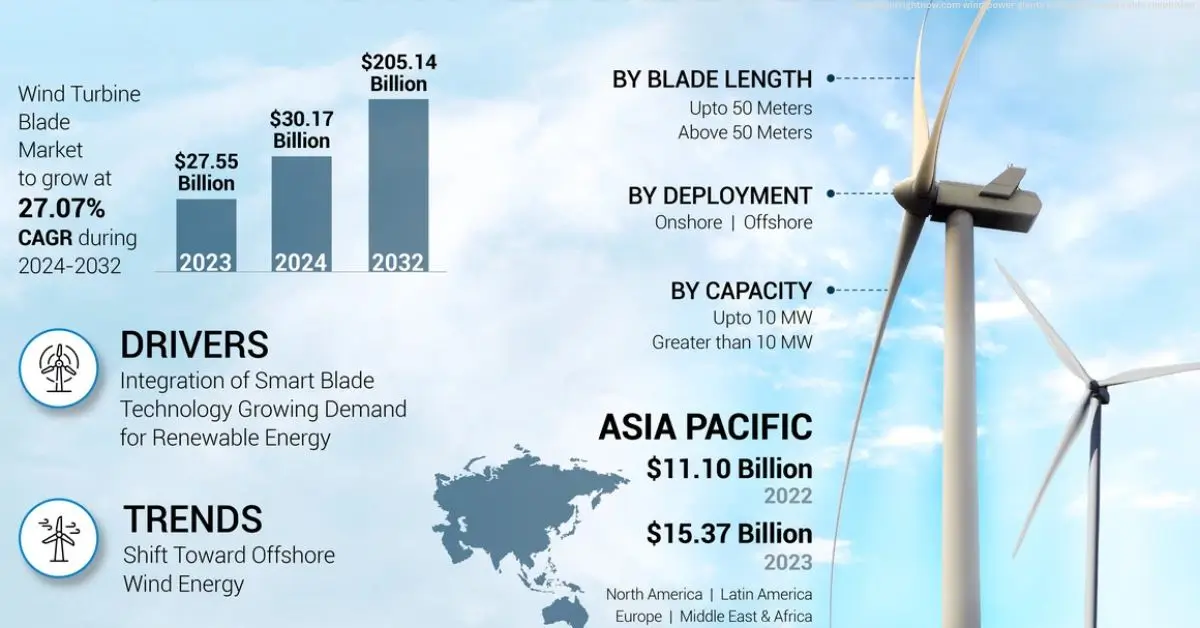

Global Wind Power Market Share

- China produced 65% of global additions in 2023.

- Offshore wind makes up just 7% of installed capacity, but it’s growing fast.

- Developers like Iberdrola are investing billions in offshore projects across Europe.

Takeaway: These firms are more than names they decide where new jobs, revenue, and clean power will land.

Investing in the Wind Revolution: Opportunities and Strategies

Is wind power a good investment? Yes it is but it depends where you look. Wind energy stocks can offer growth, but they carry policy and supply chain risks.

Comparison Table: Wind Investment Snapshot

| Company | Type | Ticker | Growth Potential | Risk Factor |

| Goldwind | Manufacturer | OTC:GWDNF | Strong in China expansion | Policy risk outside Asia |

| Vestas | Manufacturer | OTC:VWDRY | Stable global demand | Rising turbine costs |

| NextEra Energy | Developer/Utility | NYSE:NEE | Strong U.S. projects | Political headwinds |

| Iberdrola | Developer/Utility | OTC:IBDRY | EU offshore leadership | Currency + regulation |

Investor Tip: Evaluate ESG scores before buying. Strong ESG profiles often attract institutional money and reduce long-term risk.

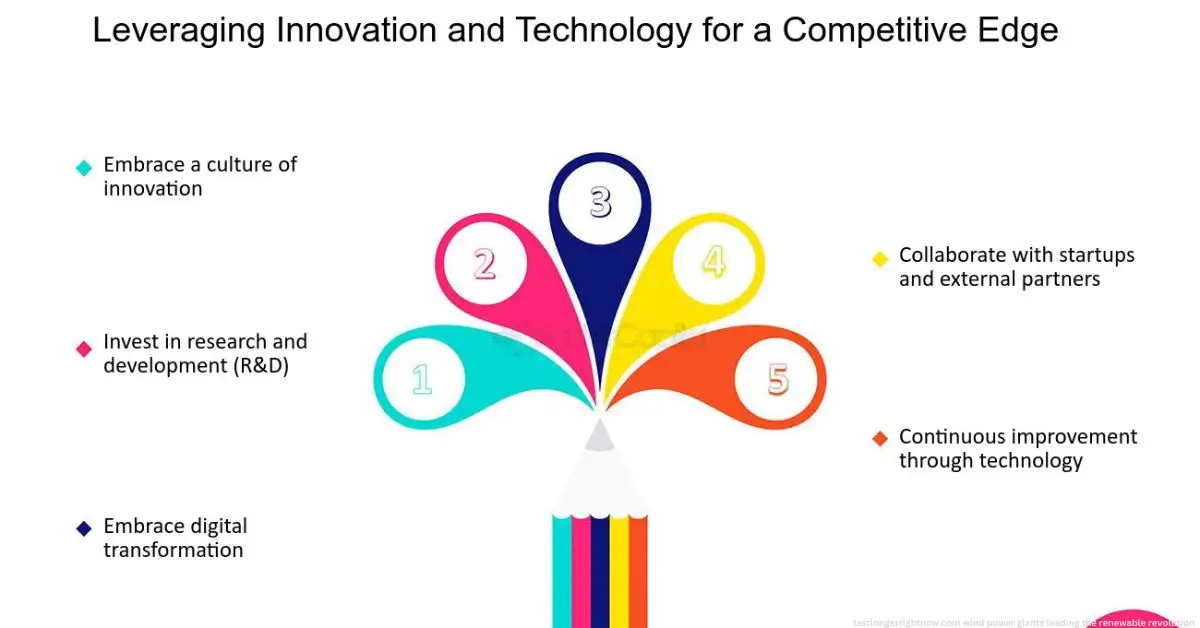

The Technology Edge: How Innovation Drives the Giants

Wind giants are competing through size, speed, and smarts.

- Bigger Turbines: Offshore platforms now exceed 15 MW per turbine, cutting costs per megawatt.

- Floating Wind: Companies like MingYang are pioneering floating platforms for deep-water projects.

- AI + Forecasting: Smart algorithms allow operators to predict wind flows and balance grids more reliably.

Think of it like this: Bigger blades capture more wind, while smarter software makes every gust count.

Myths vs Facts: Setting the Record Straight

Wind energy is powerful, but myths still confuse people.

| Myth | Fact |

| Wind is unreliable. | Forecasting and grid integration keep supply steady. |

| Turbines are too expensive. | Costs fell 60% since 2010, making wind competitive. |

| Turbines kill too many birds. | Buildings and cats cause far more deaths; modern designs reduce impact. |

| Offshore harms marine life. | Long-term studies show minimal effects, even artificial reef benefits. |

Truth is: Wind giants are solving these issues faster than critics admit.

The Road Ahead: Challenges and Forecasts

The future of wind power is bright but not easy.

- Growth Targets: The IEA says annual installations must triple to 340 GW by 2030 to meet climate goals.

- Supply Chains: Heavy reliance on China creates geopolitical risks for Western economies.

- Recycling: Old blades are difficult to dispose of; new materials aim to fix that.

- Community Resistance: Noise, visual impact, and land rights remain barriers.

Bottom line: Success depends on solving ethics and logistics as much as scaling turbines.

How to Support and Implement Wind Power

Different audiences can play a role in the renewable revolution:

- Investors: Screen companies for ESG compliance and diversified projects.

- Policymakers: Focus on stable regulation, grid modernization, and community engagement.

- Communities: Negotiate benefits like local jobs and shared revenue when hosting turbines.

- Students & Researchers: Explore floating offshore, AI integration, and recycling tech as growth fields.

Action Tip: Even small steps from investing in wind ETFs to advocating for local clean energy feed into the global transition.

Sources

To ensure credibility, the insights in this article draw from trusted global authorities on energy markets and wind technology:

- International Energy Agency (IEA): Global outlook on wind energy systems and renewable transition trends.

- BloombergNEF: Data-driven analysis of Chinese dominance and global turbine installations.

- Wood Mackenzie: Market share research on the leading wind turbine manufacturers worldwide.

- Global Wind Energy Council (GWEC): Industry benchmarks and annual supplier performance insights.

- U.S. Department of Energy (DOE): Official wind market reports, project pipelines, and policy-backed forecasts.

Conclusion

Wind power giants are not just building turbines they’re shaping the future of clean energy. From Chinese manufacturers leading global supply to developers like Ørsted and NextEra driving massive projects, these firms are proving that renewables can scale at speed. For investors, policymakers, and communities, the message is clear: lastlongerrightnow.com wind power giants leading the renewable revolution are central to climate goals, energy security, and economic growth. The next decade will decide how far and how fast this revolution goes.

FAQ’s

Who is the largest wind power company in the world?

Goldwind held the top spot in 2024, supplying about 14% of global turbines.

Which countries produce the most wind energy?

China leads by far, followed by the United States, Germany, and Spain.

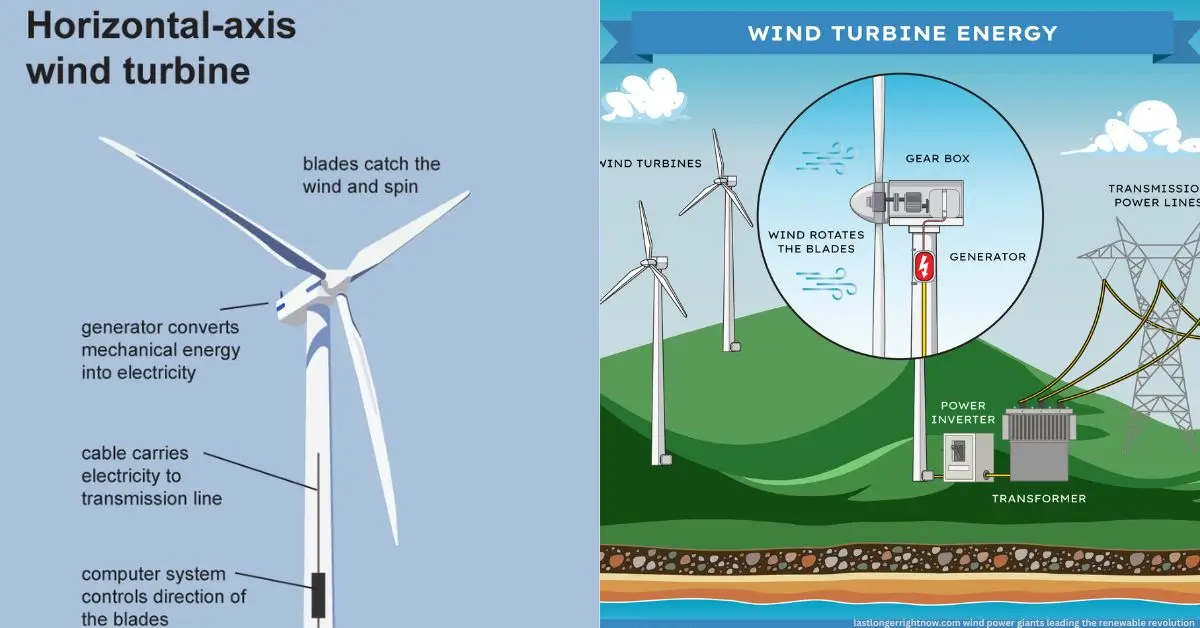

How does offshore wind power work?

Turbines are placed in shallow or deep waters to capture stronger, steadier winds and send electricity back to shore.

What are the biggest challenges in wind energy?

Supply chain risks, recycling turbine blades, and local community resistance are key hurdles.

Why is wind power important for climate change?

It cuts carbon emissions affordably, already powering over 10% of U.S. electricity in 2023.

What are the latest wind turbine innovations?

Floating offshore designs and AI-driven forecasting are driving efficiency gains.

How much electricity can a wind farm generate?

Large onshore farms produce hundreds of megawatts, while offshore projects can reach gigawatt scale.

Author Bio

Ethan Rowell is a clean energy analyst with 9 years of experience covering wind and solar markets. He focuses on how technology and investment trends shape the renewable transition.

For more informational insights you can watch: